Number: 104-14

Date: December 06, 1995

HOUSE PASSES RETIREMENT EARNINGS TEST BILL

On December 5, 1995, the House passed H.R. 2684, the Senior Citizens' Right To Work Act of 1995, by a vote o f 411-4. Members voting against the bill were: Beilenson (D- CA), J ohnston (D- FL), La Falce (D- NY) , and Watts (D-NC). In the Senate, a companion bill, S. 1432, was introduced by Senator McCain (R-AZ) on November 28. The Senate Committee on Finance is expected to take action on the bill before Congress adjourns for the holidays.

As passed by the House, H.R. 2684 includes the following:

Increase in the Earnings Test Annual Exempt Amount

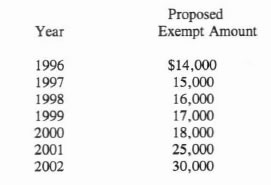

- Beginning in 1996, gradually raise the earnings limit for the retirement earnings test (RET) for beneficiaries who have attained normal retirement age to $30,000 by 2002 (compared with $14,760 under current law based on the intermediate assumptions in the Trustees Report). The applicable 1996 exempt amount under current law is $11,520. Exempt amounts under the bill would be:

After 2002, the annual exempt amount would be indexed to growth in average wages. The substantial gainful activity (SGA) amount applicable to individuals who are statutorily blind would no longer be linked to the RET exempt amount for individuals ages 65 to 69. Instead, the SGA amount for blind people would continue to be adjusted annually as under present law, i.e., based on the national average wage index.

Dependency Test for Stepchildren

- To get benefits, a stepchild would have to be receiving at least one-half support from the stepparent when the child's claim is filed. (The option for finding dependency based on living-with would be eliminated.) This provision would be effective for benefits of individuals who become entitled after the third month following the month of enactment.

If the natural parent and the stepparent of an entitled stepchild divorce, benefits to the stepchild would terminate 6 months after SSA is notified of the divorce. This provision would be effective for final divorces that SSA is notified of on or after the date of enactment.

One-Year Delay in Benefit Recomputations

Benefit recomputations for workers who have earnings in years after the year in which they reach normal retirement age would not be effective until the second year following the year of higher earnings (rather than the following January), unless the year being replaced is a year of zero earnings.

- The provision applies to benefit recomputations based on wages or self-employment income earned after 1994.

Revocation by Clergy of Exemption from Social Security Coverage

- Clergymen who have elected to be exempted from Social Security coverage can request revocation of the exemption for a limited time. The revocation must be requested by the due date of the tax return for the second taxable year after the year of enactment (by April 15, 1998, if enactment occurs in 1995).

Continuing Disability, Renew (CDR) Administration Revolving Account for Title II Disability Benefits

- Establishes through FY 2002 a CDR Administration Revolving Account in the

Federal Disability Insurance (DI) Trust Fund as a source of non-appropriated

administrative funds to help finance DI CDRs. The account would be initially

funded with $300 million transferred from amounts otherwise available in the

DI Trust Fund and would thereafter be credited at the start of each fiscal year

with an amount equal to the estimated present value of savings to the OASDI

and Medicare Trust Funds (as certified by SSA's Chief Actuary) fiowing from

CDRs conducted in the prior fiscal year. Expenditures from the Account could be used only for the purpose of conducting CDRs.

- Requires explicit annual certifications from SSA's Chief Actuary. Therefore, the provision also establisbes statutorily the position of Chief Actuary.

- Requires the Commissioner to include in SSA's CDR Report to Congress a final accounting of the amounts transferred to the Account during the year, the amount made available from the Account during the year pursuant to certifications made by SSA's Chief Actuary, and the expenditures made for processing CDRs during the year, including a comparison of the number of CDRs conducted during the year with the estimated number of CDRs upon which the estimate for such expenditures was made.

- The provision is applicable only for fiscal years beginning on October 1, 1995,

through September 30, 2002, and sunsets October 1, 2002.

Elimination of the Role of SSA in Processing Attorney Fees

Eliminates the current law r equirement that SSA withhold and pay attorney fees. Caps the amount a representative may charge for representing claimants in cases in which SSA makes a favorable determination at the administrative level at $4,000. Provides that a court may determine and allow as part of its judgment a reasonable fee for claimant representation, whenever a court renders a favorable determination.

- Applies to initial claims filed and claims with first time representation 60 days on or after enactment.

Initial of Disability Benefits to Drug Addicts and Alcoholics

Prohibits DI and SSI eligibility to individuals whose drug addiction and or alcoholism (DAA) i s a contributing factor material to the finding of disability. This provision would apply with respect to monthly benefits for months beginning after enactment and to current beneficiaries on January 1, 1997. If current beneficiaries whose benefits terminate because of this provision reapply for benefits within 120 days after the date of enactment, SSA must make new medical determinations for such individuals no later than January 1, 1997.

Applies representative payee requirements to any DI or SSi beneficiary who has a DAA condition, as determined by the Commissioner, that prevents that beneficiary from managing benefits. SSA would refer, as appropriate, these individuals to the appropriate State agency for treatment. These provisions would apply to applications filed after the date of enactment.

Provides an appropriation of $100 million for each of FYs 1997 and 1998 to carry out activities relating to the treatment of drug and alcohol abuse under the Public Health Service Act.

Benefit and Tax Statements

Requires SSA to conduct a pilot study of the efficacy of providing retired workers with information about their Social Sceurity benfits and taxes. The study would involve a sample of retirement benficiaries whose entitlement began in or after 1984. SSA would ssend them estimates of their aggregate covered earnings, their aggregate Social Security taxes (including the employer share), and the total amount of benefits paid on their record.

The study would have to be conducted within a 2-year period beginning as soon as practicable in 1996 and a report on its results would be due to Congress within 60 days of its completion.

Other Recent Congressional Action:

On November 29, the Senate Committee on the Judiciary, Subcommittee on Immigration approved S. 1394 which would impose new limits on the number of legal immigrants allowed into the U.S. each year. The Subcommittee also agreed to combine S. 1394 with S. 269 which, among other provisions, would restrict SSI benefits to noncitizens and establish an employment verification and benefit eligibility system (See Legislative Bulletin 104-8). The combined legislation will probably be taken up by the full committee early next year.