| |

1935 Social Security Act

|

FEDERAL TAXES WITH RESPECT TO EMPLOYMENT (TITLE VIII)

COVERAGE (See. 811 b):

Federal taxes are to be paid by all employers and employees based

on wages received in employment in any service performed within the

United States, Alaska, and Hawaii except:

1. Agricultural labor;

2. Domestic service in a private home;

3. Casual labor not in the course of employer's trade or business;

4. An individual who has attained 65 years;

5. Officers or members of the crew of a vessel documented under the

laws of the United States or of any foreign country;

6. Employees of the United States Government;

7. Employees of a State or a political subdivision;

8. Employees of nonprofit institutions operated exclusively for religious,

charitable, scientific, literary or educational purposes, or for the

prevention of cruelty to children or animals;

9. Employees of a carrier as defined in (Public No. 400, 74th Cong.

[H. R. 8652]).

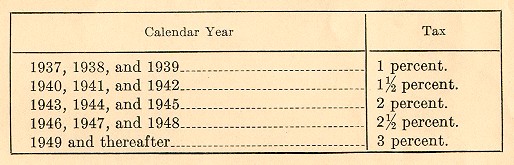

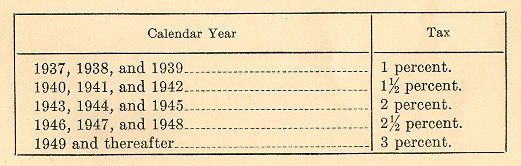

RATES OF TAXES:

Taxes assessed on wages not counting in excess of $3,000 annually

paid any individual (sec. 811a).

INCOME TAX ON WAGES OF EMPLOYEES (Sec. 801)

Income tax on employee collected by employer by deducting the tax

from wages (sec. 802a), but such a tax not to be allowed as a deduction

in computing net income for Income Tax purposes (sec. 803).

EXCISE TAX ON WAGES PAID BY EMPLOYERS (Sec. 804)

FEDERAL ADMINISTRATION:

Taxes collected by Bureau of Internal Revenue under direction of Secretary

of Treasury and paid into United States Treasury as internal-revenue

collections (sec. 807a). Commissioner of Internal Revenue with approval

of Secretary of Treasury makes rules for enforcement of title (sec.

808).

Taxes collected in such manner, at such time, and under such conditions

(either by making and filing returns or by stamps, coupons, tickets,

books, or other reasonable devices or methods) as may be prescribed

by the Commissioner of Internal Revenue, who furnishes to the Postmaster

General a suitable quantity to be kept at post offices. The Postmaster

General at least once a month transfers to Treasury as internal revenue

collections all receipts so deposited (sec. 809). |

|