| |

|

|

BASIC PROGRAM PRINCIPLES

|

Work-Related

The first principle underlying the program is that security

for the worker and his family grows out of his own work. He earns

his future security as he earns his living and he pays toward the

cost of his social security protection out of his earnings.

Contributory

Because his contributions help meet the costs of the benefits,

an insured worker can expect the benefits to be paid to him and his

dependents or survivors without undue restrictions. The knowledge

that it is possible to plan ahead on one's own, without the fear of

having to exhaust all savings and resources should earnings stop,

encourages him to provide additional protection for himself through

personal savings, private insurance, home ownership, and other investments.

The contributory nature of the program also encourages a responsible

attitude toward the program. Knowing that the financing of the present

program and of any improvements that are made in it depends on social

security taxes that he helps to pay, the worker has a personal interest

and stake in the soundness of the program.

Compulsory

Another important principle is that to the extent possible

coverage is compulsory. A society cannot be secure if large numbers

of its members are not protected against the loss of earnings that

results from the retirement, disability, or death of the family provider.

If the program were not compulsory, many of the people who need its

protection most would not participate. Many low income workers, for

example, as much as they might recognize the need to protect themselves,

would choose not to pay social security tax contributions because

of the difficulty they have in meeting their current needs. In the

end they would have to be supported through assistance from the general

revenues of the Government.

|

|

|

|

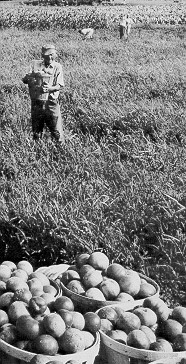

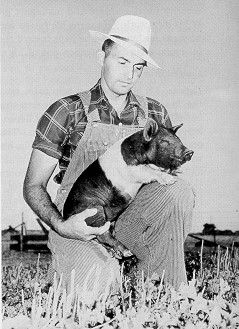

A worker earns his future security

as he earns his living and as he pays toward the cost of his

social security protection out of his earnings.

Under the social security law as first enacted, only employees

in commerce and industry were covered. Since that time, coverage

has been extended to almost every occupational group--to the

self-employed in the cities, to household employees, to farm

people, and also to the Armed Forces.

|

Rights Clearly Defined in Law

Still another principle is that a person's rights to social

security benefits--how much he gets and under what conditions--are

clearly defined in the law. A person who meets the conditions provided

in the law must be paid, and if a claimant disagrees with the decision

in his case, he can appeal to the courts.

Because the conditions of eligibility and the amount of benefits to

be paid are clearly set out in the law and are generally related to

facts that can be objectively determined, the area of administrative

discretion is greatly circumscribed. And since payment is not discretionary,

a person is free to act without fear that his personal or political

behavior will keep him from getting benefits.

Self-Supporting

The program is designed so that contributions plus interest

on the investments of the social security trust funds will be sufficient

to meet all of the costs of benefits and administration, now and into

the indefinite future--without any subsidy from the general funds

of the Government. Both the Congress and the Executive Branch, regardless

of political party in power, have scrupulously provided in advance

for full financing of all liberalizations in the program.

In its studies of the social security law and possible changes in

that law, Congress reviews the operations and status of the trust

funds and the estimates for the future and also hears the testimony

of actuaries and other financial experts both inside and outside the

Government.

Even when social security legislation is not under consideration,

Congress continues to keep an eye on the financial operations of the

social security program: Section 201 (c) of the Social Security Act

provides for a Board of Trustees of the Trust Funds, composed of the

Secretary of the Treasury, the Secretary of Labor, and the Secretary

of Health, Education, and Welfare. The Board of Trustees is required

by law to make a report to Congress each year on the operations and

status of the Funds during the previous fiscal year and expected operations

and status in the 5 following years and for the long-run future.

The Social Security Act also requires that an Advisory Council be

appointed every few years to review the financing of the program and

to prepare a report of findings and recommendations. |

|